At its core, a fixed cost is an expense that doesn't change no matter how much your business produces or sells. A variable cost, on the other hand, moves up and down directly with your level of activity. Getting this distinction right is the first real step toward building a solid financial game plan for your company.

What Are Fixed and Variable Costs, Really?

Let’s ditch the dry, textbook definitions for a minute.

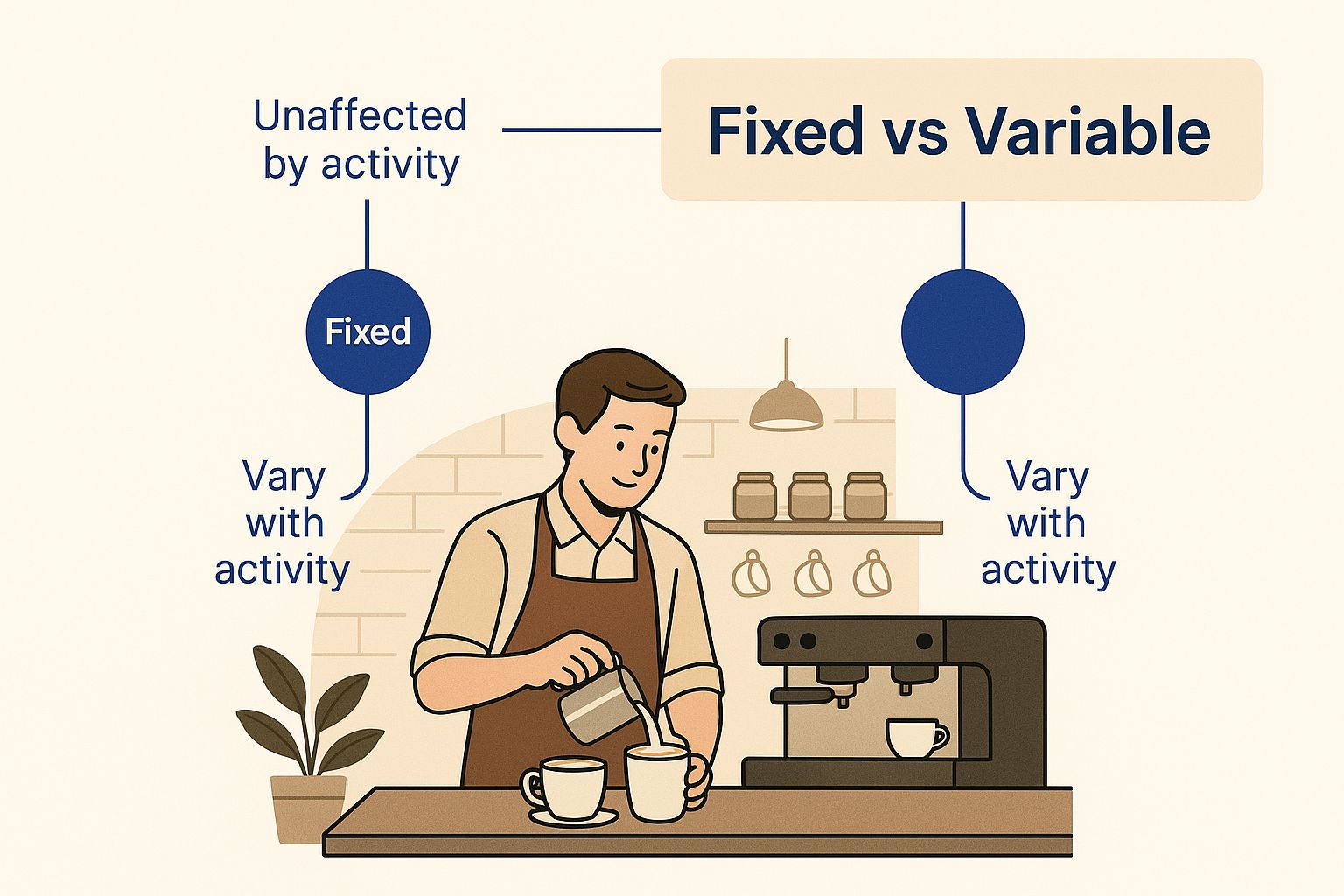

Picture yourself running a neighborhood coffee shop. The monthly rent you pay for your storefront? That's a classic fixed cost. You owe the same amount every month, whether you sell one cup of coffee or a thousand. Your head barista's salary is another good example, it’s a predictable expense you can budget for.

Now, think about the coffee beans, milk, and paper cups. Those are your variable costs. The more lattes you whip up, the more of these supplies you have to buy. These expenses rise and fall right alongside your sales. This simple coffee shop scenario perfectly illustrates the fundamental difference between these two core business costs.

The Predictable and the Unpredictable

Fixed costs offer one thing above all else: predictability. They’re the financial foundation of your operations, the baseline you have to cover just to keep the lights on. Because they’re constant, they are much easier to forecast.

Variable costs, however, are tied directly to performance. They’re more flexible, but they also demand close tracking. If you can lower your variable costs for each item you sell, you directly improve your profit margin on every single transaction.

The real magic happens when you see how these two cost types interact. A business with high fixed costs needs to hit a certain sales target just to break even. But once it crosses that line, profits can skyrocket because the cost of producing one more item is relatively low.

This infographic helps visualize that clear split between costs that stay stable, like rent, and those that scale with your output, like raw materials.

As you can see, fixed costs give you that stable baseline, while variable costs are directly linked to your business's day-to-day hustle.

To make it even clearer, here’s a quick side-by-side comparison to help you lock in the differences.

Fixed Costs vs Variable Costs At a Glance

| Characteristic | Fixed Costs | Variable Costs |

|---|---|---|

| Behavior | Stays constant regardless of business activity | Changes in direct proportion to business activity |

| Timeframe | Remains the same over a specific period (e.g., monthly, annually) | Fluctuates in the short term, tied to production or sales volume |

| Predictability | High; easy to budget and forecast | Low; harder to predict without accurate sales forecasts |

| Per-Unit Cost | Decreases as production volume increases | Stays the same for each unit produced or sold |

| Examples | Rent, salaries, insurance, software subscriptions | Raw materials, sales commissions, packaging, shipping |

This table neatly sums up the core distinctions, making it easier to categorize your own business expenses.

Real-World Cost Structures

The relationship between fixed and variable costs isn't just an academic exercise, it's critical in every industry, from tiny shops to massive factories. A great example is manufacturing.

A car manufacturer might pay $250 to produce one steering wheel (a variable cost) but also face $550,000 annually in factory rent (a fixed cost). Whether the factory produces 1,000 cars or 10,000, that $550,000 rent check is due. Meanwhile, the steering wheel costs scale perfectly: 1,000 cars mean $250,000 in steering wheels, while 10,000 cars require a whopping $2,500,000. If you want to dive deeper, you can discover more insights about how these structures impact production and profitability.

How Cost Knowledge Shapes Smarter Decisions

Knowing the difference between a fixed and variable cost isn't just an accounting exercise, it's a massive strategic advantage. This knowledge becomes your secret weapon for making smarter, more resilient business decisions, turning abstract numbers into real-world outcomes that drive profitability and growth. When you can clearly separate what you must pay from what you pay as you grow, you unlock a powerful new way to see your entire business model.

This distinction is the bedrock of accurate financial forecasting. Instead of taking wild guesses about future expenses, you can build nuanced, reliable models. Your fixed costs give you a stable baseline, while your variable costs can be mapped directly to sales projections. This lets you run realistic "what-if" scenarios, preparing your company for both booms and busts with far more confidence.

This level of insight moves you from reactive spending to proactive financial management. You'll know exactly which levers to pull when the market shifts.

Calculating Your Break-Even Point

One of the most powerful things you can do with this knowledge is calculate your break-even point. This is the magic number, the precise level of sales you need to hit to cover all your costs. Once you cross that line, every single sale contributes directly to your profit.

To find it, you just need three things:

- Total Fixed Costs: All the expenses that stay the same no matter what (think rent, salaries).

- Variable Cost Per Unit: How much it costs to produce one more item or deliver one more service.

- Sale Price Per Unit: What you charge for that item or service.

The formula gives you a crystal-clear target. For instance, if your fixed costs are $10,000 a month and you make $20 in profit on each sale, you know you need to sell 500 units just to cover your baseline. Anything beyond that is pure profit. This clarity completely transforms how you set goals and track performance.

Mastering Pricing and Profit Margins

With a firm grip on your cost structure, you can set prices that do more than just cover expenses, they guarantee a healthy profit margin. If you know that your variable costs climb steeply with each sale, you can build a pricing model that protects your profitability as you scale.

On the other hand, if most of your costs are fixed, you have more flexibility. Once those fixed costs are covered, the cost of each additional sale is pretty low. This might allow you to use competitive pricing to grab more market share. This kind of strategic pricing is flat-out impossible without first separating your fixed and variable costs.

Knowing your cost DNA allows you to price for profit, not just for survival. It empowers you to confidently decide whether to compete on volume, quality, or price, all while ensuring your business remains financially sound.

The Power of Operating Leverage

This brings us to a crucial concept called operating leverage. A business with high fixed costs and low variable costs, like a software company or a hotel, has high operating leverage. This creates a double-edged sword.

During periods of growth, high operating leverage is fantastic. Once fixed costs are covered, profits can soar because the cost of serving each new customer is minimal. A small bump in sales can lead to a huge jump in net income.

But the risk is much greater during downturns. That high "cost floor" of fixed expenses has to be paid no matter what, making the business more vulnerable to economic slumps. Understanding your operating leverage helps you assess your risk profile and build a more resilient company. This is where asking smarter cloud finance questions becomes essential, as it helps align your technology spend with your overall financial strategy. By analyzing your cost structure, you can better prepare for volatility and make informed decisions that protect your bottom line.

Decoding Cost Structures Across Industries

The whole idea of fixed and variable costs isn't a one-size-fits-all concept. Far from it. Different industries are playing completely different ballgames, with unique financial pressures that shape their business models. If you want to benchmark your own performance and make smart strategic moves, you have to understand these dynamics.

Think of a business's cost structure as its financial fingerprint. For some, variable costs make up the bulk of the balance sheet, which creates a flexible but sometimes nerve-wracking financial landscape. For others, a heavy foundation of fixed costs provides stability but also introduces massive risk if revenue takes a nosedive.

Let's look at two very different businesses, a temporary staffing agency and a hotel, to see how this plays out in the real world.

The Service Sector: A Deep Dive into Staffing Agencies

Temporary staffing agencies are a classic example of a business driven almost entirely by variable costs. Their main expense? The wages they pay to the temporary staff they place with clients.

This cost scales directly with business activity. If they place more workers, their expenses shoot up. If business slows down, their biggest cost shrinks right along with it. This makes for a super flexible model.

Their fixed costs are usually pretty low, things like office rent, marketing, and the salaries for a small internal team. This structure lets them pivot quickly to meet market demand without getting crushed by a huge baseline of expenses.

But this reliance on variable costs also means profit margins can be razor-thin and need to be watched like a hawk. Even a small change in billing rates or staff pay can make or break their profitability.

Here’s a real-world scenario. Imagine a small staffing firm that bills its clients $30 per hour and pays its temp staff $22 per hour. The firm’s fixed costs, rent, internal salaries, and so on, add up to $10,200 a month.

If they manage to bill for 800 hours in a month, their variable costs hit $17,600 (800 hours x $22). Their total revenue for that month is $24,000 (800 hours x $30). But when you add it all up, their total costs ($27,800) are higher than their revenue, leaving them with a $3,800 loss. This shows just how critical volume is in a business like this. For a more detailed look at this kind of math, you can check out this cost analysis on REDFworkshop.org.

The Hospitality Industry: The Weight of Fixed Costs

Now, let's flip the script and look at the hotel industry, which sits on the complete opposite end of the spectrum. Hotels are all about massive fixed costs. These are the bills that have to be paid every single month, whether they have one guest or are fully booked.

For a hotel, the property itself is the biggest cost driver. Mortgage or lease payments, property taxes, insurance, and the salaries of full-time staff create an enormous financial hurdle that must be cleared before the business can turn a profit.

This high fixed-cost structure has some major implications:

- High Operating Leverage: Once a hotel covers its fixed costs, the variable cost of checking in one more guest (think laundry, mini-shampoos, and a quick clean) is tiny. This means that after hitting the break-even point, every additional booking dramatically boosts profitability.

- Vulnerability in Downturns: The flip side is the huge risk during slow seasons or an economic slump. Those massive fixed costs don't just disappear, and an empty hotel can quickly become a financial black hole.

Comparing a staffing agency to a hotel perfectly illustrates the two extremes. One is agile and scales with demand. The other needs a ton of volume to cover its baseline but can rake in profits once it gets there. Figuring out where your own business lands on this spectrum is the first step toward building a resilient financial strategy.

Managing the Weight of Rising Fixed Costs

Are your fixed costs starting to feel like a financial anchor? For a lot of businesses, the baseline expenses required just to keep the lights on are climbing. This isn't just about one or two bills; it's a combination of rising rent, full-time staff salaries, and essential software subscriptions that you have to pay no matter what.

This ever-higher "cost floor" can seriously cramp a company's style, especially when the economy gets shaky. When a huge chunk of your budget is already spoken for, you have way less room to maneuver. It makes the business fragile during slow periods and can even stop you from seizing opportunities when things are good.

The Growing Burden on Businesses

This isn't just a feeling, it's a real trend happening across many sectors. The hotel industry gives us a perfect, real-world example of this problem in action. A close look at fixed and variable cost trends over the last two decades tells a very clear story.

Data from CBRE Hotels Research shows that before 2007, the cost per available room (CPAR) and the cost per occupied room (CPOR) moved pretty much in sync. This pointed to a healthy balance between fixed expenses and the costs that scaled with how many guests they had. But after 2007, things changed. The CPAR started rising much faster than the CPOR, signaling that fixed costs were bloating and creating a heavier financial load for hotels, full or not. You can dig into the details and learn more about these hospitality cost trends to see the full picture.

This trend highlights a critical risk for any business with a high fixed cost structure. As that baseline expense grows, the break-even point gets higher, demanding more revenue just to stay afloat.

This forces leaders to get creative about managing expenses that seem set in stone. The good news is, there are practical strategies you can use to get some of that financial agility back and build a leaner, more resilient operation.

Proactive Strategies for Cost Flexibility

The secret to managing heavy fixed costs is to find ways to make them act more like variable costs. I know, that sounds impossible for things like rent or long-term contracts, but with the right approach, you can inject a surprising amount of flexibility back into your budget.

Here are a few strategies to get you started:

- Negotiate Variable Lease Terms: Instead of a traditional flat-rate lease, why not explore a percentage lease where your rent is tied to your revenue? This directly aligns one of your biggest fixed costs with how your business is actually performing.

- Explore Agile Staffing Models: Relying only on full-time salaried employees locks you into a rigid payroll. By bringing in skilled contractors or freelancers, you can scale your workforce up or down with demand. Just like that, a chunk of your labor costs shifts from fixed to variable.

- Audit All Recurring Expenses: Those monthly software subscriptions and other automated payments add up faster than you think. Make it a habit to regularly audit these costs to cut out redundant tools and find savings. This absolutely includes your tech spend; too many companies overlook the hidden cost of idle VMs and other cloud resources that quietly inflate their fixed cost base.

By turning fixed obligations into more flexible, variable ones, you lower your financial risk. This shift doesn't just make your business tougher during downturns, it also frees up cash to pour into growth when opportunities knock. Building this kind of agility is a must for long-term success.

Applying Cost Principles to Your Cloud Spend

The classic business principles of fixed and variable cost aren't just for running a factory or a coffee shop, they're incredibly relevant to managing your cloud budget. Your monthly bill from AWS or Azure can feel like a chaotic jumble of charges. But when you start looking at it through this lens, you bring a ton of clarity and control to your spending.

It’s a simple shift in mindset. Instead of seeing one big, intimidating number, you start to break it down. Some of your cloud costs behave just like traditional fixed costs, giving you stability and predictability. Others are purely variable, shooting up or down with every user click or API call. Spotting the difference is the first real step toward smart cloud cost optimization.

Cloud Costs as Fixed Expenses

In the world of cloud computing, a fixed cost usually comes from making a long-term commitment in exchange for a hefty discount. These are the predictable, recurring charges that don’t change no matter how much you use the service from one minute to the next. They create a solid, stable foundation for your core infrastructure.

Here are a few common examples you’ll see:

- Reserved Instances (RIs) and Savings Plans: When you promise providers like AWS or Azure that you'll use a certain amount of compute for one or three years, they give you a much lower hourly rate. That commitment acts as a fixed cost.

- Annual Software Subscriptions: Think about licenses for security tools, databases, or other platforms you buy through a cloud marketplace. These often have a fixed monthly or annual fee, completely separate from your usage.

- Dedicated Hosts: If you rent an entire physical server just for your own use, that cost is typically fixed for the length of your contract.

These fixed commitments are a perfect match for workloads that have steady, predictable demand. Got a core application server that needs to be on 24/7? Locking it in with a Reserved Instance is a no-brainer. You're effectively turning a volatile variable cost into a much lower, predictable fixed one.

Cloud Costs as Variable Expenses

On the flip side, you have variable costs. This is the heart of the cloud's pay-as-you-go promise. These expenses are directly tied to your consumption. If your website traffic doubles overnight, these costs will probably double, too. That flexibility is incredibly powerful, but it's also why you need to keep a close eye on things to avoid budget blowouts.

Cloud services that almost always fall into the variable bucket include:

- On-Demand Instances: Paying for virtual machines by the hour or second with no strings attached is the classic variable cost. Usage goes up, costs go up. Simple as that.

- Serverless Functions (e.g., AWS Lambda): Here, you only pay for the exact compute time you use, right down to the millisecond. It’s the ultimate variable cost, scaling perfectly with demand.

- Data Transfer and Storage: What you pay for moving data out of the cloud (egress) or for storing files in services like Amazon S3 will fluctuate directly with how much data you’re actually handling.

The pay-as-you-go model gives you amazing flexibility, letting you scale resources to meet demand without overprovisioning. But that same flexibility can lead to unpredictable bills if you aren't closely monitoring and understanding your usage patterns.

Making the Strategic Choice

The real key to optimizing your cloud budget is knowing when to use each cost model. The game is to strategically convert variable costs into fixed costs wherever it makes financial sense. By digging into your usage patterns, you can pinpoint those stable, always-on workloads that are prime candidates for Reserved Instances or Savings Plans.

This kind of analysis is a core practice in FinOps and is fundamental to effective cloud cost management and how to do it. Why pay the premium on-demand rate for a server that runs all the time when you could slash its cost by up to 72% with the right commitment?

Of course, this isn't an all-or-nothing game. A smart cloud financial strategy is almost always a hybrid one. You cover your predictable, baseline needs with low-cost fixed commitments. Then, you rely on the flexibility of variable, on-demand resources to handle unexpected traffic spikes or short-term projects. This balanced approach gives you the best of both worlds: serious cost savings and the agility to react when you need to.

Time to Build Your Strategic Cost Playbook

Thinking about fixed and variable costs isn't just some boring accounting exercise. It's the bedrock of a tough, resilient financial strategy. When you truly get it, abstract numbers on a spreadsheet transform into a powerful tool you can use to drive profitability and long-term stability. This is how you move from reacting to your bills to proactively making data-driven decisions that secure your company’s future.

Ultimately, your goal is to understand how every single dollar you spend behaves. Fixed costs are your baseline, the financial floor you have to cover no matter what. Variable costs, on the other hand, dance in step with your growth and day-to-day activity.

Key Takeaways for Your Business

Let's boil this down to a few core principles you can put into practice right away:

- Nail Down Your Break-Even Point: Use your fixed and variable cost data to figure out the exact sales volume you need to cover every last expense. This number is your single most critical performance benchmark.

- Know Your Industry's DNA: Are you more like a hotel with massive fixed costs, or a staffing agency where costs are almost entirely variable? Understanding your business model helps you manage risk and spot opportunities others might miss.

- Tame Your Fixed Expenses: Be relentless in finding ways to turn fixed costs into variable ones. Can you negotiate more flexible lease terms? Could you use an agile staffing model instead of hiring full-time for every role? Every conversion makes your operation leaner and more adaptable.

The real power comes when you stop seeing your cost structure as a limitation and start seeing it as a set of levers you can pull. When you understand these levers, you can build a more agile and profitable business that's ready for any economic climate.

Alright, time to put this into practice. Take a fresh, honest look at your own expenses. Carve out some time to do a proper cost audit, categorizing every single expense as fixed, variable, or a hybrid of the two. This simple exercise alone will give you immediate clarity and shine a spotlight on real, actionable ways to optimize.

Start today. Go build a more financially sound tomorrow.

Got Questions? We've Got Answers

Let's tackle some of the most common questions that come up when people start digging into their fixed and variable cost structures.

Can a Single Cost Have Both Fixed and Variable Parts?

You bet. In fact, many business costs aren't purely one or the other. We call these "mixed" or "semi-variable" expenses, and they're more common than you think.

A classic example is your company's internet bill. You likely have a flat monthly fee for the service, that's the fixed part. But if you go over your data cap, you get hit with extra charges. Those overage fees? That's the variable component kicking in. The same logic applies to a salesperson's pay, which often includes a fixed base salary plus a variable commission that depends on how much they sell.

How Often Should I Be Reviewing My Cost Structure?

This isn't a "set it and forget it" task. Think of it as a regular financial health checkup. The right frequency really depends on your business and industry, but a deep dive at least once a quarter is a solid baseline.

However, some events should trigger an immediate review, no questions asked:

- Big Market Swings: A sudden recession or a boom in customer demand means you need to re-evaluate your cost flexibility right away.

- Major Business Moves: Launching a new product line or expanding to a new region will absolutely change your cost dynamics.

- Pre-Budgeting Season: You can't build an accurate financial forecast for next year without a crystal-clear picture of your current cost behavior.

Consistent reviews keep you nimble and ensure your spending is actually helping you hit your goals.

Understanding your costs isn't a one-and-done project; it's an ongoing strategic process. Staying on top of it allows you to adapt on the fly, keep spending in check, and protect your profit margins no matter what the market throws at you.

What's the Best First Move to Lower High Fixed Costs?

The smartest place to start is with a full-blown audit of every single recurring expense. It's easy for "cost creep" to happen, where subscriptions and services pile up over time. Before you can cut anything, you need to know exactly where the money is going.

Make a list of every fixed cost, rent, insurance, software licenses, salaries, you name it. Then, put each one under the microscope. Is this absolutely essential? Is there a cheaper alternative? Can we renegotiate the contract? This process almost always uncovers quick wins, like ditching redundant software or downgrading a service you're not fully using. This audit gives you the data you need to make bigger, more strategic moves, like exploring flexible staffing or renegotiating that long-term office lease.

Ready to take control of your cloud costs? CLOUD TOGGLE helps you eliminate waste from idle servers, turning a volatile variable cost into a predictable, optimized expense. Start your free trial and see how much you can save.