Cost allocation methods are simply the ways businesses divvy up indirect costs to specific products, departments, or projects. This isn't just about bookkeeping; it's about getting a real, honest look at profitability to make smarter financial decisions. It takes you past basic expense tracking and shows you what’s truly driving costs inside your company.

Why Cost Allocation Is a Strategic Business Tool

Ever tried to split a dinner bill fairly? If one person just had a salad while another went for the full three-course meal with drinks, splitting it evenly down the middle would feel wrong. It’s the same in business. You need effective allocation of costs methods to see which parts of your operation are actually pulling their weight.

This process is so much more than an accounting chore, it's a powerful tool for growth.

When you allocate costs accurately, you can finally see which products, services, or departments are genuinely profitable and which ones are quietly draining your resources. Without this clarity, a company could pour money into an unprofitable product line for years, simply because its true costs are buried in general overhead.

The Foundation: Direct vs. Indirect Costs

Before diving in, you have to get clear on two fundamental types of costs. Nailing this distinction is the first step toward picking the right allocation approach for your business.

- Direct Costs: These are the easy ones. They can be traced directly back to a specific "cost object," like a product or project. Think of the wood used to build a table or the salary of a developer working only on one software application.

- Indirect Costs: This is where it gets tricky. These are shared expenses that are essential for running the business but aren't tied to a single item. We're talking about office rent, administrative salaries, or the company's utility bills. These are the costs that need a solid allocation method.

The core challenge of cost allocation lies in finding a fair and logical way to distribute these indirect costs. The method you choose directly impacts everything from pricing strategies to budget forecasting.

Getting this right gives you a complete financial picture, which is the foundation of smart decision-making. It means you can set prices that not only cover all your expenses but also deliver a healthy profit. This visibility helps you spot opportunities for efficiency and decide with confidence where to invest your company's resources for the biggest return.

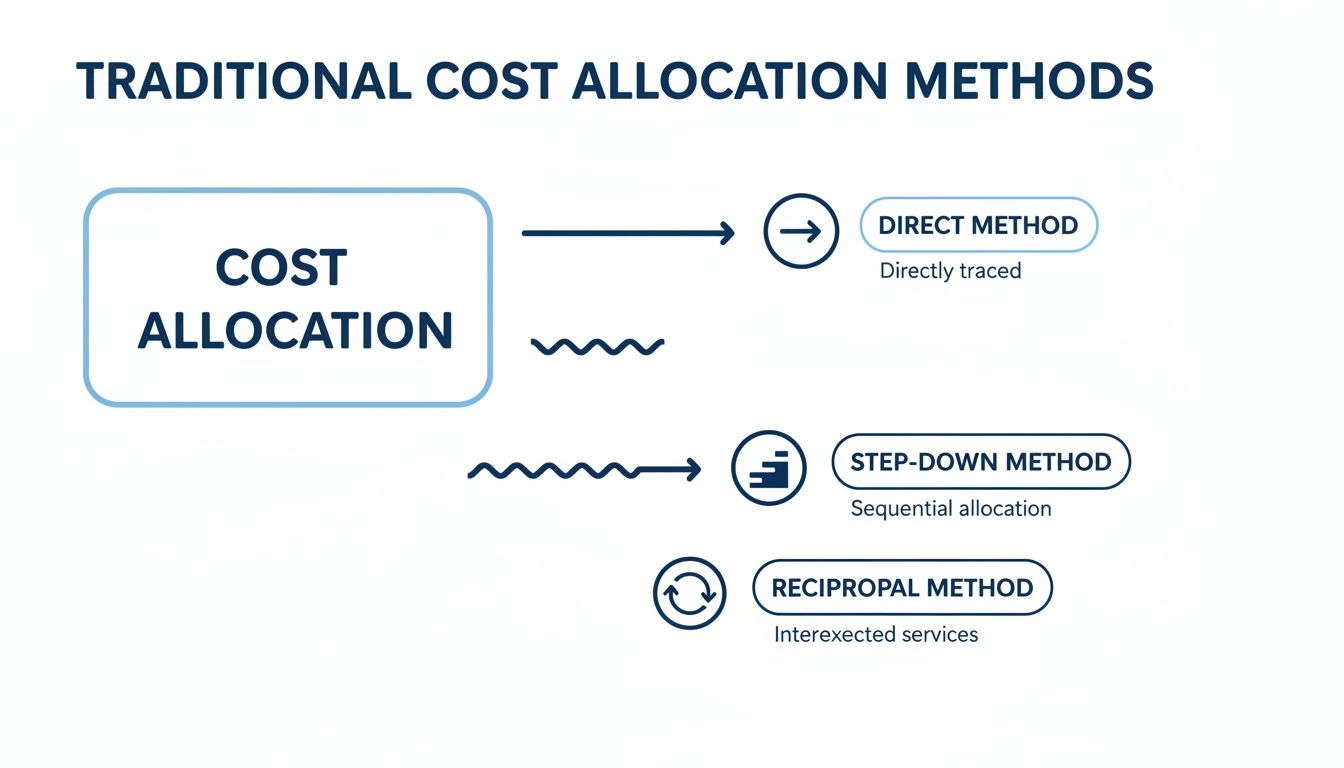

A Look at Traditional Cost Allocation Methods

To really get a handle on modern cost management, it helps to first understand the classic methods businesses have been using for decades. Think of these traditional approaches as a toolkit, with each tool offering a different level of precision. They start simple and get more complex, all with the goal of giving you a clearer picture of where your money is actually going.

The whole idea of systematically assigning overhead costs isn't some new-fangled concept; it's been around for a while. Back in the late 18th and early 19th centuries, British textile factories were already moving beyond basic bookkeeping to more sophisticated ways of divvying up overhead. A great example of this leap forward was the Waltham System, put into place around 1817 in Massachusetts textile mills, which introduced precise departmental costing. These early pioneers proved that smart allocation was good for business. Textile companies that adopted these systems saw their profit margins jump from 5% to 12% between 1820 and 1880.

The Direct Method

The Direct Method is about as straightforward as it gets.

Let's say you have two departments that make your product (Production A and Production B) and two departments that support them (HR and IT). The Direct Method takes all the costs from HR and IT and assigns them straight to Production A and B. It completely ignores any work the support departments do for each other.

It's quick, easy, and doesn't require a lot of number-crunching, which makes it a decent fit for smaller businesses where the support teams don't interact much. But that simplicity is also its biggest flaw. By pretending internal support functions don't exist, it can give you a skewed view of your real operational costs.

The Step-Down Method

The Step-Down Method, sometimes called the sequential method, adds a bit more nuance. It acknowledges that support departments help each other out, but it does so in a one-way street fashion.

First, you rank your support departments, say, HR then IT. You allocate all of HR's costs to every other department, including IT. Then, you move on to IT and allocate its new total cost (including what it just got from HR) to the remaining production departments.

The catch? Once a department's costs are allocated, it's done. It can't receive any costs from departments further down the line. It's definitely more accurate than the Direct Method, but it still doesn't quite capture the full, messy reality of how departments work together.

The Reciprocal Method

If you're after the highest accuracy from these traditional methods, you'll want the Reciprocal Method. This one finally accepts the reality that support departments provide services to each other simultaneously. IT supports HR, and HR supports IT; it's a two-way street. To account for this, the method uses a system of simultaneous equations to figure it all out.

This method gives you the most precise cost breakdown because it recognizes just how interconnected your internal teams really are. It makes sure that both fixed and variable costs are allocated much more accurately, giving you a truer sense of what each department is really costing you.

While it’s the most accurate of the bunch, the Reciprocal Method is also the most complex and time-intensive to set up. You have to decide if the payoff in precision is worth the administrative headache. Getting a good grip on how different costs behave is key here; you can learn more about fixed and variable costs in our detailed guide. Ultimately, picking the right method comes down to balancing your need for accuracy with the time and resources you have available.

While the old-school methods give you a decent starting point, today’s businesses are just too complex for a one-size-fits-all approach. Spreading overhead costs evenly is like trying to paint a detailed portrait with a paint roller. You get the job done, but you miss all the important details. Modern cost allocation methods are like giving you a full set of fine-tipped brushes for much greater accuracy.

The real star of the modern toolkit is Activity Based Costing (ABC). Instead of using broad-stroke measures like machine hours to divvy up costs, ABC gets way more specific. It works on a simple but powerful idea: products don’t create costs, activities do. A product requires certain activities (like machine setups, quality checks, or customer service calls), and those activities are what consume resources and money.

This change in perspective gives you a much clearer picture of your actual profitability, especially if you have a wide range of products or services. By zeroing in on cost drivers, the specific actions that generate expenses, ABC can assign overhead costs with surgical precision. For example, machine setup costs get tied directly to the number of production runs for a specific product, not just smeared across everything you produce.

How Activity Based Costing Works in Practice

Putting ABC into action involves a few key steps that set it apart from the older, broader methods. The goal is to shift from lumping all your overhead into a few big buckets to understanding exactly what's driving your expenses.

- Step 1: Identify Activities: First, you map out all the distinct activities your team performs. Think order processing, quality inspections, machine maintenance, or customer support calls.

- Step 2: Create Cost Pools: Next, you group your overhead costs into "pools" based on those activities. For example, all expenses related to processing customer orders would go into the "order processing" pool.

- Step 3: Find the Cost Drivers: For each pool, you need to identify a logical cost driver. What action causes this cost to go up or down? For the procurement department, the number of purchase orders issued is a great cost driver.

- Step 4: Calculate the Rate: Now, you calculate an overhead rate for each activity. Just divide the total cost in the pool by the total number of cost driver units (e.g., total procurement cost / total purchase orders).

- Step 5: Allocate the Costs: Finally, you assign the overhead costs to your products or services based on how much of each activity they actually use.

This careful approach stops high-volume, simple products from being unfairly loaded with costs generated by low-volume, complex ones. Getting this level of detail is a cornerstone of modern financial operations, often called FinOps. If you're looking to get a handle on this discipline, our guide on what FinOps is and why it matters is a great place to start.

Other Modern Cost Allocation Models

Beyond ABC, there are other practical methods that businesses use, especially for large-scale projects. The infographic below shows how the traditional methods really paved the way for these more advanced approaches.

As you can see, there’s a natural progression from the simple direct method to the more interconnected reciprocal method, setting the stage for even more dynamic models.

Two other useful approaches are top-down and parametric cost allocation. Top-down is great for early-stage budgeting; you start with a total project budget and then break it down into smaller pieces based on percentages or priorities.

Parametric modeling gets a bit more data-driven. It uses historical data and statistical relationships to estimate costs. Think of common benchmarks in construction, like $50 per square foot, or in software development, like $200 per line of code. These models help you create quick, reliable estimates that are essential for planning big projects.

Cost Allocation Methods in the Real World

The theory behind cost allocation is great, but it really clicks when you see it in action. These frameworks truly show their value when applied to real business problems, whether you’re running a traditional factory floor or a modern tech company.

Let's walk through two completely different examples to see how these methods solve different challenges.

Example 1 The Manufacturing Company

Imagine a company called "Precision Parts Inc." that makes widgets. It has two departments that actually build the products (Assembly and Finishing) and two that support the whole operation (HR and IT).

The company needs to figure out how to assign its $50,000 in HR costs and $80,000 in IT costs to the production lines. This is the only way they’ll know the true cost of making each part. They decide to use the Step-Down method.

First, they have to decide which support department to allocate first. Since HR supports everyone in the company, including the IT staff, it makes sense to start there.

- Step 1: Allocate HR Costs. The $50,000 HR budget is split up based on how many employees are in each department. A portion goes to IT, and the rest is divided between Assembly and Finishing.

- Step 2: Allocate IT Costs. Now, it's IT's turn. We take their original $80,000 plus the share they just received from HR. This new, larger total is then allocated to the production departments based on how many computers each one uses.

This sequential process gives a much clearer picture than the simple Direct Method because it rightly acknowledges that the IT department uses HR services, too. The final costs in Assembly and Finishing are now a much fairer reflection of the company's total overhead.

Example 2 The SaaS Company

Now, let's jump over to a completely different world: "Innovate SaaS," a software company running its platform on a shared Kubernetes cloud environment. Their total infrastructure bill comes to $100,000 a month, and they need to split that cost fairly across their three product teams: Product A, Product B, and Product C.

Just splitting the bill three ways would be wildly inaccurate since each product uses the cloud infrastructure very differently.

Innovate SaaS opts for Activity-Based Costing (ABC), one of the most precise allocation of costs methods you can find for complex tech environments.

They start by identifying the specific activities that drive up their cloud bill and find a "cost driver" for each.

- API Calls: Costs tied to this activity are allocated based on the raw number of API requests each product's service handles.

- Data Storage: These costs are distributed based on the gigabytes of data each product is actually consuming.

- CPU Hours: This chunk of the bill is allocated based on the computational power each product's application uses.

By tying costs directly to specific usage metrics, Innovate SaaS gets a crystal-clear view of their spending. They can now see that Product C, with its massive data storage needs, is responsible for a much larger slice of the bill than Product A, an insight that was totally hidden before.

This approach delivers true cost visibility. The product managers for A, B, and C can see exactly how their team's technical decisions impact the company’s bottom line. It empowers them to optimize their code and resource usage, giving them real ownership over their spending.

How to Choose and Implement the Right Method

Picking a cost allocation method isn't just an accounting chore, it's a strategic decision. The best choice really depends on how complex your business is, what you're trying to achieve, and how much time and effort you're willing to put in.

There’s no magic bullet here. The goal is to find the right fit for your unique situation.

For example, a small retail shop with a simple setup can probably get by just fine with the Direct Method. It's straightforward, quick, and gives enough information to keep costs in check without creating a huge administrative headache. The extra precision from a more complicated model simply wouldn't be worth the trouble.

On the other hand, a big consulting firm with multiple service lines and shared support departments would get completely skewed numbers from a simple method. For them, putting in the effort to implement something like Activity Based Costing (ABC) is non-negotiable if they want to understand which services are actually profitable.

Key Factors for Your Decision

Before you jump in, take a hard look at your business through these lenses. Your answers will point you toward the most sensible approach.

- Business Complexity: How many departments, products, or services are you juggling? The more moving parts you have, the more you'll need a sophisticated method like ABC or the Reciprocal Method to get a true picture of your costs.

- Cost vs. Benefit: Let's be real, implementing a detailed system costs time and money. Ask yourself if the sharper insights and better decisions you'll get will actually justify that investment.

- Strategic Objectives: What’s the end game? Are you trying to optimize a specific product, make a department more efficient, or figure out more competitive pricing? Your method should feed directly into your main business goals.

Activity Based Costing delivers far more accuracy than traditional, volume-based methods. For companies with a mature Technology Business Management (TBM) model, ABC provides the granular detail needed to see the true cost of delivering services. A 2023 survey of Fortune 500 firms found that those using ABC achieved 25-35% more precise unit costs. The trade-off? Its complexity means a full implementation can take anywhere from 6-12 months. You can explore more about these findings on TBM modeling.

Your Implementation Roadmap

Once you’ve settled on a method, a clear plan will make the rollout much smoother. This helps you build a system that's not just accurate, but also one you can stick with.

- Identify Cost Objects: First, figure out exactly what you're allocating costs to. This could be anything from products and projects to entire departments or even specific customers.

- Create Cost Pools: Next, group your indirect costs into logical buckets. For instance, you can lump everything related to your building like rent, utilities, and maintenance into a "facility costs" pool.

- Choose Allocation Bases: For each cost pool, pick a driver that makes sense. You need a clear cause-and-effect link. Square footage is a classic driver for facility costs, while employee headcount works well for HR expenses. For more tips on this part of financial planning, check out our guide on creating budgets and forecasts.

- Calculate and Allocate: Finally, do the math. Calculate the allocation rate for each pool and apply it to your cost objects based on how much of the driver they used.

Common Questions About Cost Allocation

Diving into cost allocation always brings up a few practical questions. Getting clear, straightforward answers is the key to building a financial strategy that you can actually trust. Let's walk through some of the most common things people ask.

Think of this as a quick way to tackle those nagging challenges and get more comfortable with how allocation of costs methods work in the real world.

How Often Should We Review Our Allocation Methods?

Your business isn’t static, so your cost allocation model shouldn't be either. The best practice is to give your approach a thorough review at least annually. You should also revisit it anytime there's a major business change, like launching a new product, reorganizing the company, or seeing a big shift in how you operate.

Regular reviews make sure your methods are still telling an accurate story about how your business uses its resources. An outdated method can create misleading financial reports and lead to poor strategic decisions. For example, if your model is based on direct labor hours but you've just invested heavily in automation, it’s not relevant anymore.

For fast-growing or rapidly changing companies, a quarterly check-in is even better. This proactive stance keeps your financial data clean and ensures your allocation strategy is helping, not hurting, your business goals.

Staying flexible means your financial insights will always keep pace with your company's evolution.

What Are the Most Common Implementation Mistakes?

Setting up a cost allocation system can be tricky, and a few common pitfalls can easily derail the whole effort. Knowing what they are is the first step to avoiding them.

One of the biggest mistakes is picking an allocation base that has nothing to do with how a resource is actually consumed. A classic example is allocating IT costs based only on employee headcount. That might unfairly penalize a department with a lot of people but very light tech needs.

Other frequent slip-ups include:

- Inaccurate Cost Buckets: Misclassifying a direct cost as indirect (or vice-versa) can throw off your entire process right from the start.

- Poor Communication: If you don't get buy-in from department heads, you'll face resistance and a lack of cooperation when it's time to gather the data you need.

- Over-Engineering It: Sometimes, a simple method is better. A system that's too complex to maintain can quickly become more trouble than it’s worth.

How Can Software Automate and Simplify This Process?

Modern software is a game-changer for making cost allocation more efficient and less prone to human error. Automation can do the heavy lifting from pulling data to running the calculations, freeing up your team to focus on analysis and strategy.

For cloud-based businesses, platforms can automatically track who's using what and apply your allocation rules on the fly. This is absolutely essential in dynamic environments where costs can change in the blink of an eye. These tools give you real-time visibility, helping you spot trends and problems as they happen, not weeks later. This ensures your allocation is consistently accurate with minimal manual effort.

Ready to stop wasting money on idle cloud resources? CLOUD TOGGLE makes it simple to automate server schedules, reduce your cloud spend, and gain control over your infrastructure costs. Start your free trial and see how much you can save.